Unlock Financial Prosperity: Understanding the Differences Between Wealth and Investment Management

Are you struggling to grow your wealth and secure your financial future? Unlocking financial prosperity requires a clear understanding of the distinct roles of wealth and investment management. This article will shed light on the differences between these two essential services, empowering you to make informed decisions and achieve your financial goals.

The Pain Points

Many individuals face challenges when it comes to financial prosperity. They may feel overwhelmed by the complex world of investing, uncertain about how to preserve their wealth, or unsure of the best strategies for long-term financial growth.

The Solution

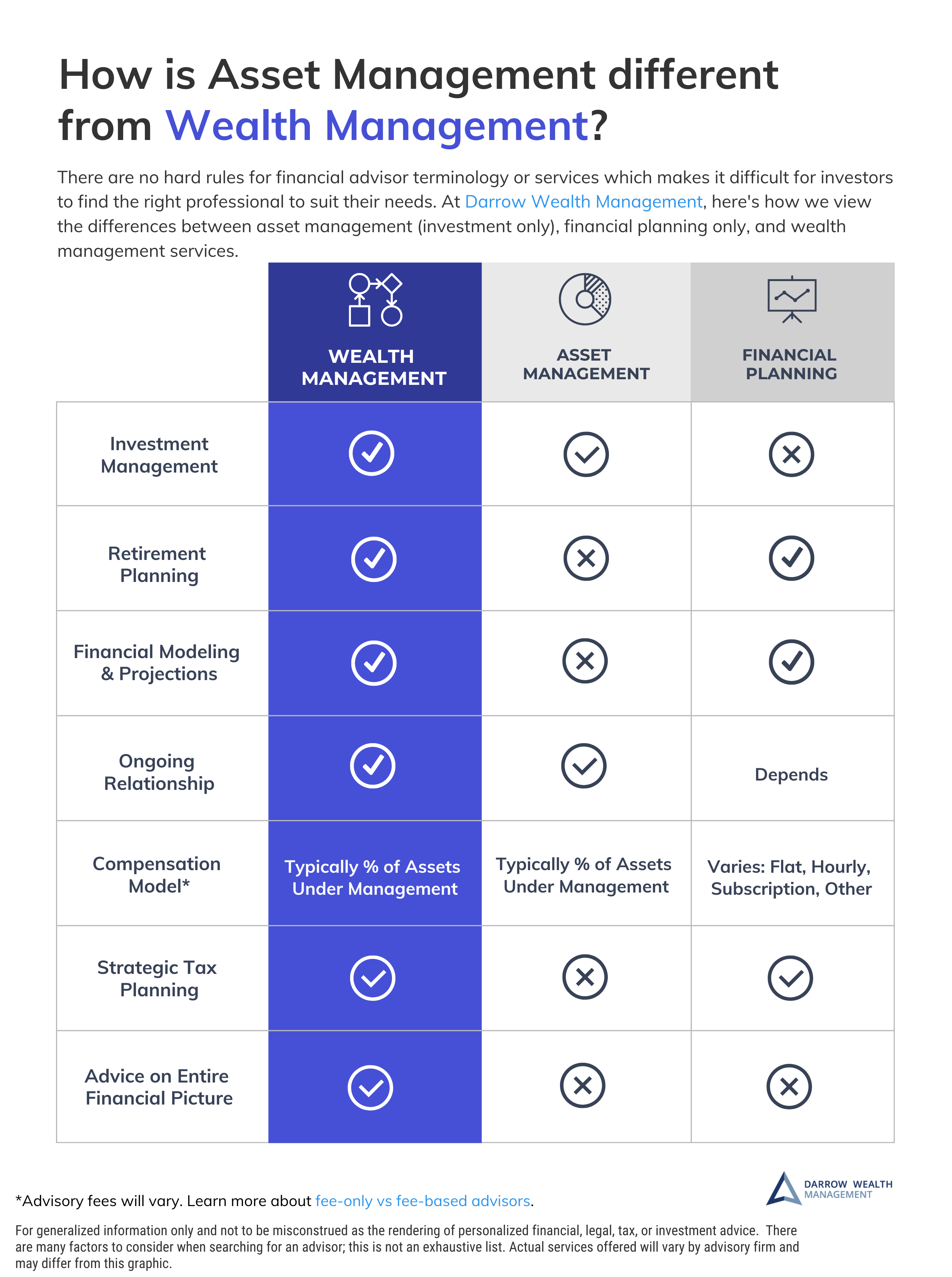

Unlocking financial prosperity involves a comprehensive approach that addresses both wealth and investment management. Wealth management focuses on preserving and growing your assets, while investment management aims to maximize returns through strategic investments. By understanding the differences between these services, you can tailor a plan that meets your unique financial needs and goals.

Summary

Wealth management encompasses a holistic approach to financial planning, considering your entire financial picture. It involves managing your assets, reducing financial risks, and planning for the future. On the other hand, investment management focuses on making investment decisions to grow your wealth and meet specific financial objectives.

Unlocking Financial Prosperity: Understanding Wealth Management

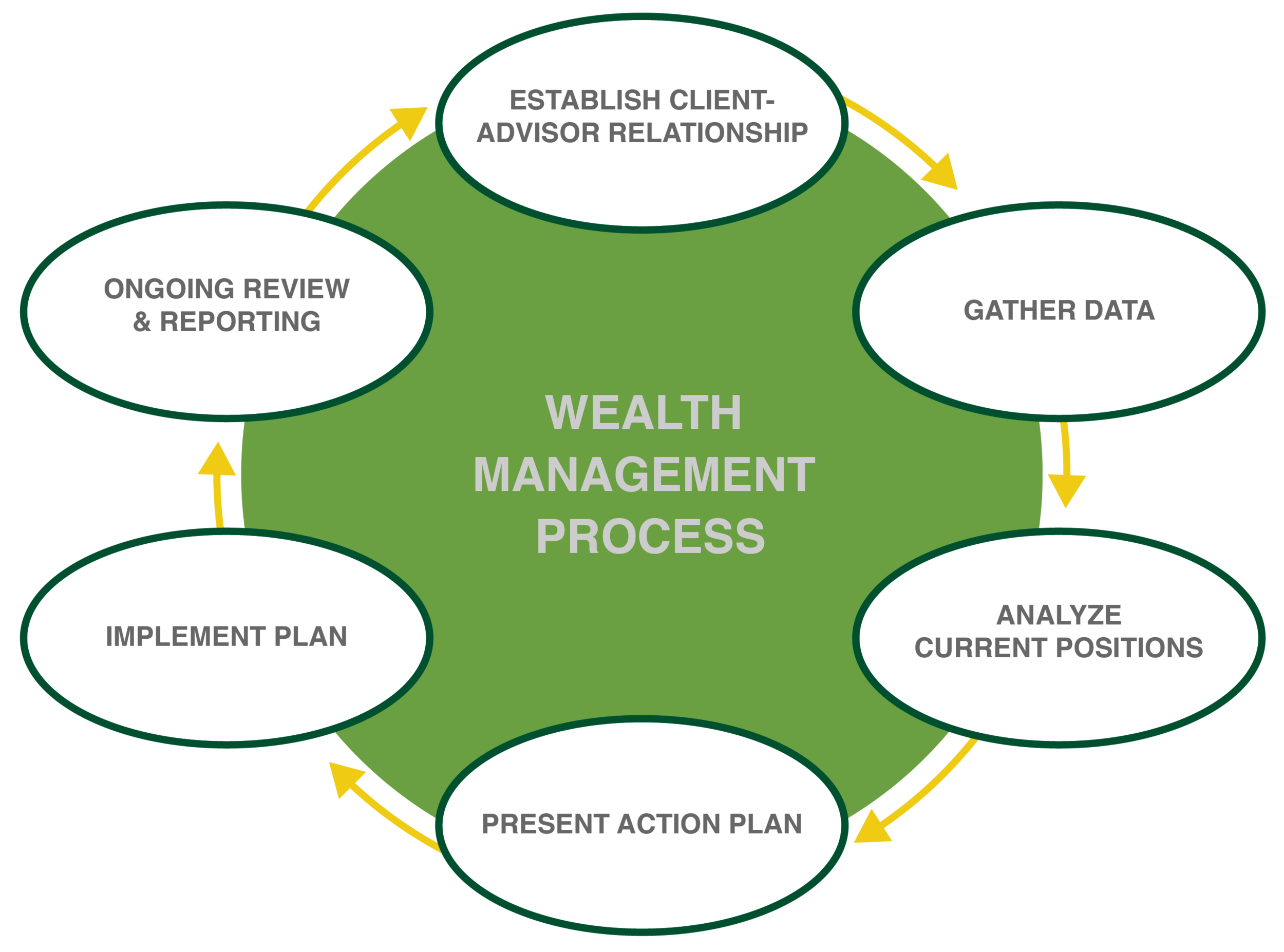

Wealth management is an essential service for individuals looking to preserve and grow their wealth. It involves a comprehensive approach that considers your entire financial picture, including:

- Asset management: Preserving and enhancing the value of your investments

- Risk management: Minimizing financial risks and protecting your assets

- Financial planning: Creating a roadmap for your financial future

- Estate planning: Ensuring the transfer of your wealth according to your wishes

Unlocking Financial Prosperity: Understanding Investment Management

Investment management focuses on making investment decisions to grow your wealth. It involves:

- Portfolio construction: Creating a diversified portfolio of investments

- Investment selection: Choosing the right investments based on your risk tolerance and financial goals

- Investment monitoring: Tracking the performance of your investments and making adjustments as needed

- Performance measurement: Evaluating the results of your investments and ensuring they are aligned with your objectives

Unlocking Financial Prosperity: History and Myths

Unlocking financial prosperity has a long history. In the past, wealth management was reserved for the wealthy. However, with the rise of modern financial services, wealth and investment management have become accessible to a wider range of individuals.

One myth is that you need a large amount of money to benefit from wealth management. In reality, wealth management can benefit individuals at all income levels by helping them plan for the future and manage their finances effectively.

Unlocking Financial Prosperity: Hidden Secrets

Unlocking financial prosperity often involves embracing hidden secrets, such as:

- Starting early: The sooner you start planning for your financial future, the more time your money has to grow

- Saving regularly: Consistency in saving is key to building wealth over time

- Investing wisely: Seeking professional advice can help you make smart investment decisions

- Managing debt wisely: Reducing debt can free up more resources for saving and investing

Unlocking Financial Prosperity: Recommendations

Here are some recommendations for unlocking financial prosperity:

- Set financial goals

- Create a budget

- Seek professional advice

- Educate yourself about investing

- Stay disciplined and don’t give up

Unlocking Financial Prosperity: Perspectives

Unlocking financial prosperity involves different perspectives:

- Long-term approach: Successful financial planning requires a long-term mindset

- Risk management: Understanding and managing financial risks is crucial

- Diversification: Spreading your investments across different asset classes can reduce risk

- Seeking professional guidance: Financial advisors can provide valuable advice and support

- Personal responsibility: Ultimately, the responsibility for financial prosperity lies with the individual

Unlocking Financial Prosperity: Tips

Here are some tips for unlocking financial prosperity:

- Set realistic goals

- Create a financial plan

- Review your plan regularly

- Be patient and persistent

- Don’t let setbacks discourage you

Unlocking Financial Prosperity: Fun Facts

Few fun facts about unlocking financial prosperity:

- The power of compound interest: Over time, compound interest can significantly increase your wealth

- The importance of saving: Even small savings can accumulate over time

- The benefit of diversification: Diversifying your investments can help reduce risk

- The value of professional advice: Financial advisors can help you make informed financial decisions

Unlocking Financial Prosperity: How-To

Unlocking financial prosperity involves:

- Setting financial goals

- Creating a budget

- Managing debt

- Investing wisely

- Seeking professional advice

Unlocking Financial Prosperity: What-If

Consider these what-if scenarios:

- What if you invested $100 every month for 30 years? (Assuming a 7% average annual return, you would have over $100,000 at the end)

- What if you saved 10% of your income and invested it wisely? (This could significantly increase your wealth over time)

- What if you sought professional financial advice? (This could help you make better investment decisions and avoid costly mistakes)

Unlocking Financial Prosperity: Listicle

A listicle of financial prosperity tips:

- Set financial goals

- Create a budget

- Review your plan regularly

- Be patient and persistent

- Don’t let setbacks discourage you

- Seek professional advice

- Educate yourself about investing

Questions and Answers

Q: What is the difference between wealth management and investment management?

A: Wealth management focuses on preserving and growing your assets, while investment management focuses on making investment decisions to grow your wealth.

Q: Who can benefit from financial planning?

A: Individuals at all income levels can benefit from financial planning, regardless of their current financial situation.

Q: What is the most important thing for achieving financial prosperity?

A: The key to financial prosperity is a long-term, disciplined approach to financial planning and management.

Q: What are warning signs that you may need to seek financial advice?

A: Warning signs include feeling overwhelmed by debt, struggling to make ends meet, or not having a plan for the future.

Conclusion of Unlocking Financial Prosperity: Understanding the Differences Between Wealth and Investment Management

Unlocking financial prosperity requires a multifaceted approach that encompasses wealth management and investment management. By understanding the distinct roles of each service, you can create a tailored plan that aligns with your unique financial goals. Remember, financial prosperity is a journey, not a destination. Stay committed to your plan, seek professional advice when needed, and never give up on your dreams of financial freedom.