Confused about Investment Management and Wealth Management and all its aspects? We’ve got you covered with this comprehensive guide.

Investing is a critical aspect of financial security but managing investments can be complex. Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors may help.

What is Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors?

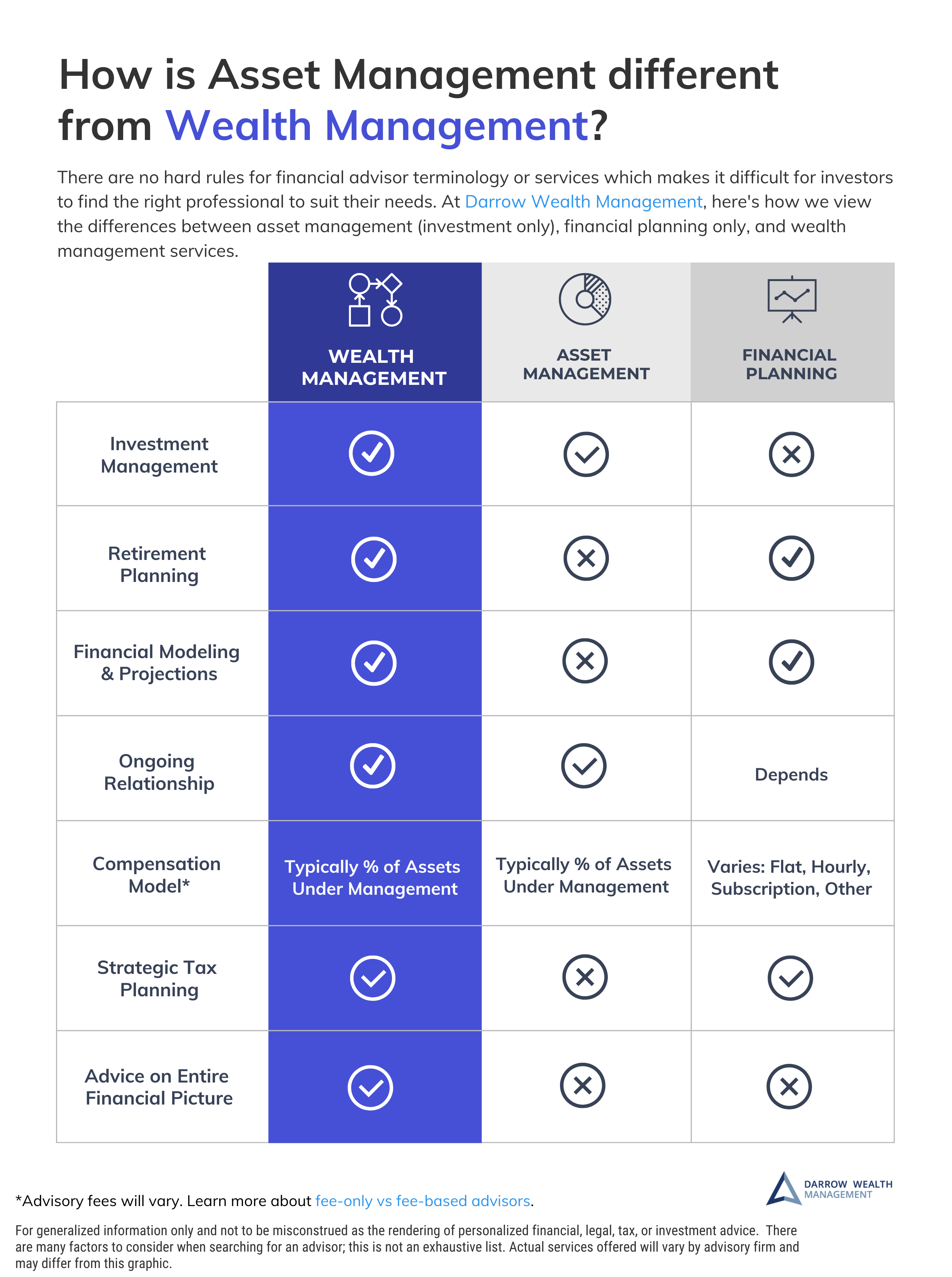

Investment management is a service that helps individuals and organizations manage their investments. Wealth management is a broader service that encompasses investment management, as well as financial planning, tax planning, and estate planning.

Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

I once struggled to manage my investments effectively. I was overwhelmed by the vast array of investment options and felt uncertain about how to allocate my assets. I sought professional help and discovered the world of investment management. An investment manager took over the reins, conducting thorough research, monitoring market trends, and making strategic decisions on my behalf. My portfolio’s performance improved significantly, giving me peace of mind and confidence in my financial future.

Investment management focuses primarily on managing investments, while wealth management takes a holistic approach, considering an individual’s overall financial situation and goals. Wealth managers provide personalized advice and guidance, helping clients navigate complex financial decisions and plan for their future.

History and Myth of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Investment management has evolved over centuries, from the days of wealthy merchants to the modern era of sophisticated financial instruments. A common myth is that investment management is only for the ultra-wealthy; however, this is not true. Investment management services are accessible to individuals of varying financial backgrounds, helping them achieve their investment objectives.

Hidden Secret of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

One hidden secret of investment management is the power of compound interest. When investments earn interest, that interest is reinvested, generating exponential growth over time. Regularly contributing to investments and allowing them to compound can significantly enhance long-term returns.

Recommendation of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Choosing between investment management and wealth management depends on individual circumstances. If you have a sizeable investment portfolio and require sophisticated investment strategies, wealth management may be a suitable option. For those with less complex financial needs, investment management may suffice.

Benefits of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Investment and wealth management services offer several benefits, including:

Tips of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

To maximize the benefits of investment management or wealth management, consider the following tips:

Risks of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Like any financial endeavor, investment management and wealth management come with certain risks:

Fun Facts of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Here are some fun facts about investment management and wealth management:

How to Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

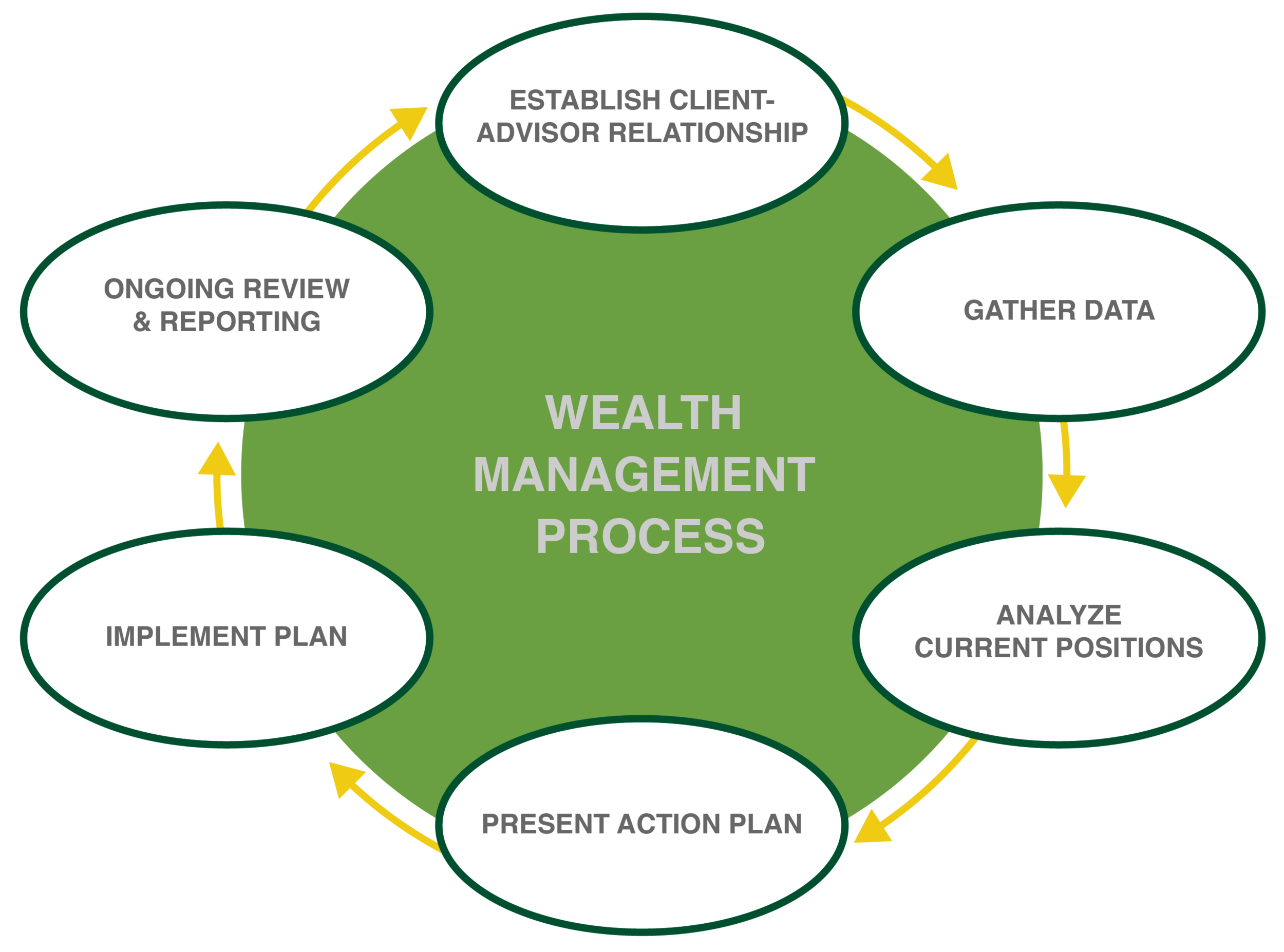

To get started with investment or wealth management, follow these steps:

What if Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

If you are unsure whether investment management or wealth management is right for you, consider these questions:

Listicle of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Here is a listicle of key differences between investment management and wealth management:

Question and Answer of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

- Q: What is the difference between investment management and wealth management?

- A: Investment management is a service that helps individuals and organizations manage their investments, while wealth management is a broader service that encompasses investment management, as well as financial planning, tax planning, and estate planning.

- Q: Which service is right for me?

- A: Choosing between investment management and wealth management depends on individual circumstances. If you have a sizeable investment portfolio and require sophisticated investment strategies, wealth management may be a suitable option. For those with less complex financial needs, investment management may suffice.

- Q: What are the benefits of investment management or wealth management?

- A: Investment and wealth management services offer several benefits, including professional investment management, personalized financial advice, improved investment performance, tax planning and optimization, and estate planning and legacy creation.

- Q: What are some tips for maximizing the benefits of these services?

- A: To maximize the benefits of investment management or wealth management, consider setting clear financial goals, diversifying your investments, rebalancing your portfolio regularly, working with a reputable and experienced professional, and monitoring your investments regularly.

Conclusion of Investment Management Vs. Wealth Management: A Comprehensive Guide For Investors

Investment management and wealth management can be valuable tools for achieving financial security and meeting your long-term financial goals. By understanding the differences between these services and choosing the right one for your needs, you can empower yourself to make informed decisions about your financial future.